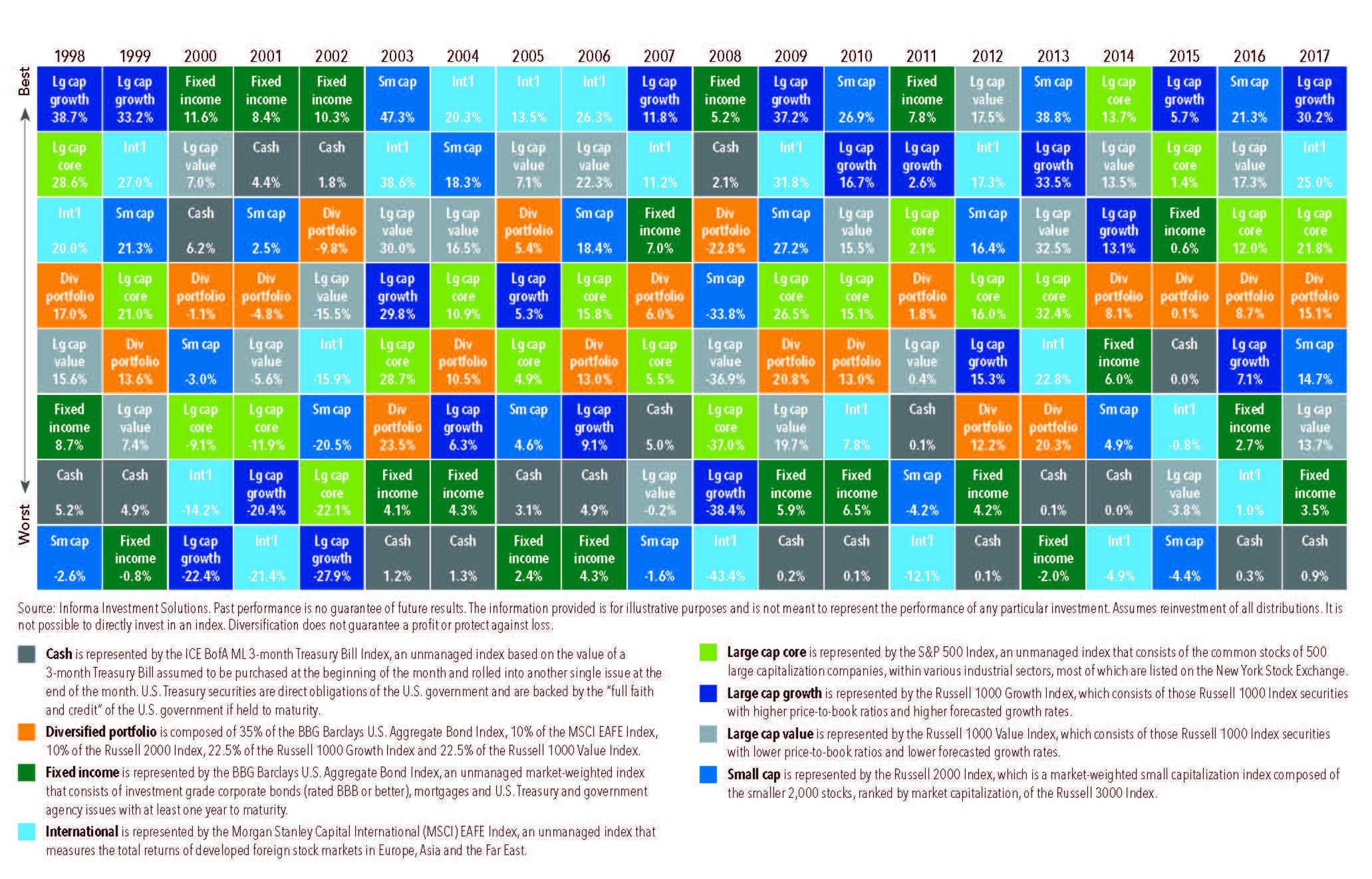

With recent wide performance differences between stocks (16.07%) vs. bonds (-4.00%), US (16.07%) vs. Non-US (-1.61%) stocks, and Information technology sector (30.21%) vs. Consumer staples sector (-1.4%) is diversification dead? Should we no longer spread our portfolio out among different asset classes, geographic regions or sectors? If you use history and probability to build a long term portfolio the answer is a resounding NO. The beauty of a truly diversified portfolio is that your portfolio will never be the worst performer and over time typically have a better risk adjusted return (which means you will get more return per unit of risk that you take). Diversifying seems pointless when we are fixated on the US stock markets performance over the last 9 years but you don’t have to look back too far to remember the benefits during the 2008 financial crisis or 2000 tech bubble. The enclosed chart shows the unpredictability of returns between different asset classes over time, but how a diversified portfolio can smooth out the roller coaster ride.

During times like these it is very hard for us to remember to stick to the process and it can become easy to look for simple solutions to fix what is a normal part of the ebb and flow of investing. We should always focus our attention on things that we can control: 1. Investing for the long-term 2. Building a global and diversified portfolio 3. Reducing internal and trade costs 4. Reducing taxes. By focusing on these 4 tenets of investing and letting the process work, you will set yourself up for a successful long-term plan.

Performance numbers were for a rolling period as of 9/12/2018. Used the following funds to use as performance substitutes for the benchmarks: IVV for stocks, AGG for Bonds, IVV for US and SPDW for Non-US.